-1.png)

Your Money

Made Easier

Taking control of your money is quick and convenient with checking accounts at On Tap.

When your needs for today Meet your goals for tomorrow

Craft Your Free Checking And Earn $150

Use promo code CHECKING150 at time of account opening.

Your checking account at On Tap is backed by our locally based teams in Colorado who are dedicated to crafting effective and personalized financial solutions that are customized to fit where you are now and where you want to go in the future.

Open Your Account In Minutes And Earn $150*

HAVE QUESTIONS ABOUT WHAT OPTIONS ARE BEST FOR YOU?

We're here to help craft the right solutions

Connect with us online to request a consultation or contact us directly at 303.279.6414 to speak with an expert.

More ATMs Than Breweries In Colorado

Never be without cash when you need it with a nationwide network of free ATMs.

No Minimum Balance Requirements

Your account works on your terms with no minimum balance required to keep your checking open.

Built-In Security and Fraud Protection

Sleep easy at night knowing your money is safely guarded and protected against fraud.

No Monthly Service Charges

It's your money, you shouldn't be paying more to access your funds when you need them.

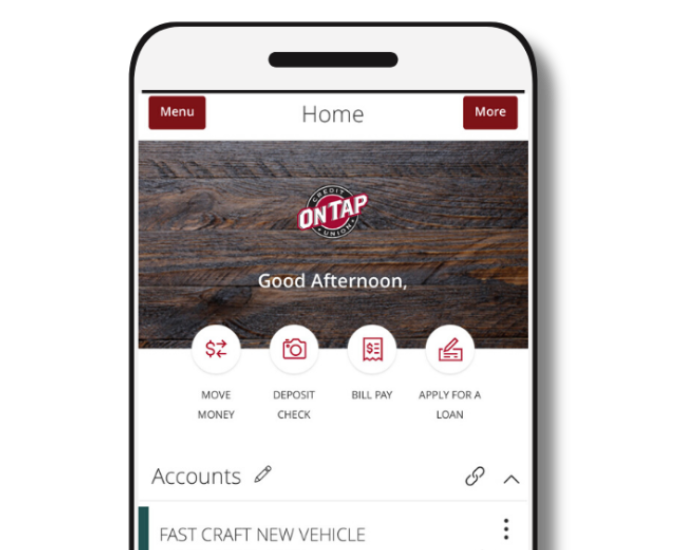

Online and Mobile Banking

Any time, anywhere. Manage your money conveniently online with ease.

Nationwide Shared Branches

Traveling outside of Colorado? No problem. Shared branches help you access your account nationwide.

Bank Any Time, Anywhere

Online and Mobile Banking

Move Money and Pay Bills

Set Notifications and Alerts

Track Your FICO Score

Lock Your Debit Card

Pay In Store On With Your Phone

Co-Op Shared Branches Nationwide

Free ATMs Nationwide

Choose The Card That's Right For You

Unique Designs For Your Wallet

Choose the free Visa® card design that best fits your lifestyle. All cards are equipped with EMV chip technology to protect your data, Lock It™ Card Control that allows you to turn your card on and off, and SecurLOCK® to guard against fraud.

"I have been banking here since I was a child. Always so impressed with the customer service here. I called to get some assistance with my account today, and Gabriel was amazing. I highly recommend banking here. I also have a loan here for a vehicle, and the interest rate was the lowest around.”

Frequently Asked Questions

What is the difference between a credit union and a bank?

Banks are for-profit institutions owned by shareholders, while credit unions are not-for-profit organizations owned entirely by the members of the credit union. This means that credit unions typically offer lower fees and better interest rates as they aim to benefit members rather than simply generating profit. Additionally, as representatives of their member base, credit unions focus on community involvement and provide a more personalized banking experience.

Who can qualify to become a member?

Joining On Tap is simple and you can become a member by living or working throughout Jefferson, Boulder, Denver, and Larimer counties. In addition, being a part of one of several local select employee groups including Colorado craft breweries, MillerCoors, Molson Coors, CoorsTek, Coors Distributing Company (CDC), Terumo BCT, and many more can qualify you for membership. Connect with us at 303.279.6414 for more details if you are unsure how to qualify.

Is there a minimum deposit amount required to join the credit union?

Yes. When you apply to become a member of On Tap, you will be required to open a savings account with a minimum deposit of $5 which will remain on hold in your account at all times. As a member owned financial institution, this $5 represents your share in the credit union and will be returned to you should you ever decide to close your account.

How can I access my account if I can't make it to a branch?

Accounts with us are always easy to access. If you do not live close to one of our two branches, we offer 24/7 access to online and mobile banking plus we participate in a CO-OP Shared Branch network, which gives members access to their accounts at more than 5,000 credit union locations and nearly 30,000 surcharge-free ATMs across the country.

Your Next Adventure Is Waiting

Make Your Money Easy In Just Minutes

Prefer Working With An Expert To get set Up?

.